Request a Term Life Insurance Quote Today

Term Life Insurance

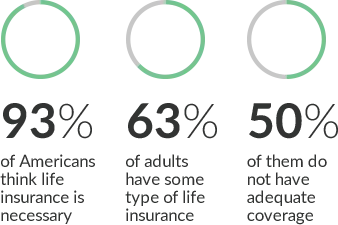

When you know you want to provide life insurance benefits to your loved ones in the event you die prematurely, it's easy to find yourself confused by all of the different types of policies, and policy options, available.

Term life insurance can be an affordable way to provide some financial protection for a specific period of time.

What Is Term Life Insurance?

Term life insurance coverage is just what it sounds like: life insurance for a specified policy term. The coverage is in effect for a term of years that you choose up front, usually ranging from 10-30 years. If you die while the policy is in force, the insurance company pays death benefits to your named beneficiaries.

As you go through life, your insurance needs change.

Symmetry Financial Group provides plans to keep you protected.

Why Do I Need

Term Life Insurance?

The number one reason for purchasing term life insurance is to provide peace of mind to your loved ones. If you were to die prematurely, would your loved ones be able to maintain their standard of living? Term life insurance can provide a cash death benefit that could be used to pay your final expenses, including the expense of a funeral service, a remaining mortgage balance, children's education expenses, or paying ongoing expenses after your death.

Why Do I Need

Universal Life Insurance?

The reasons for buying universal life insurance are almost as varied as the number of policies available for purchase.

For most people, providing a ready source of funding for grieving loved ones after death is an important consideration. When you die, will your loved ones be able to afford to pay your final expenses and debts and be able to maintain their current standard of living? If the answer is "no", it's time to explore various life insurance options to determine what makes the most sense for your situation.

How Does

Term Life Insurance Work?

Like other types of life insurance, term life insurance starts with an application for coverage with an insurance company. Once a policy is in force with the company, you pay monthly, quarterly or annual policy premiums to maintain coverage. If you die during the specified policy term, the insurance company pays the specified death benefit amount to your named beneficiaries.

How Does

Universal Life Insurance?

Just like other forms of insurance, you'll need to apply for coverage and pay an initial premium. Once your policy is in-force, you'll need to make periodic premium payments to keep your life insurance benefits.

One of the best features of universal life insurance is the flexibility with your premium. You can pay higher premiums to add to your policy's cash value when you're able. Or, if you need to reduce the premium for a period of time, you can make adjustments to the policy to accommodate that.

Choose Symmetry For Term Life Insurance

There are a lot of insurance agents and brokers offering to sell you their own company's life insurance policies. Symmetry Financial Group is different. As a truly independent insurance provider, we have access to policies from over 30 different life insurance carriers. These options allow you to shop around and find the policy that works best for you.

At Symmetry Financial Group, our clients always come first. We take the time to get to know each of our clients and understand their needs and goals before recommending any insurance solutions. We believe that helps us better serve you, because we're able to offer a variety of coverage options and solutions to meet your specific needs.

To learn more, and to get quotes for term life insurance coverage to protect your loved ones, contact us today at (828) 439-0948.

Would You Like to

Request a Quote?

Please fill out the short form so we can

provide you with the policy options to best

match your coverage and financial needs.

Frequently Asked Questions

Q: What are the advantages of

Term Life Insurance?

One of the biggest advantages of term life insurance is its affordability. Insurance companies can offer lower premium rates for term insurance coverage than for permanent policies because the odds of death during the policy term favor the insurance company. Term life insurance policies are also a great way to maintain flexibility: you can adjust the policy according to your changing needs. If you realize more permanent coverage is a better option for you, most in-force term life insurance policies can be converted to permanent life insurance.

Other advantages of term life insurance:

• It can be used to supplement life insurance coverage provided

• by your employer

• Policies provide a fixed death benefit for a time period that you

• choose up-front

• In addition to the specified "face amount" death benefit, your

• policy may include a return of premium option

• Some policies also offer other coverage options including critical

• illness and disability insurance protection

Of course, there are a lot of policies and policy options to choose from. When you're considering purchasing a term life insurance policy, you'll want to keep your financial situation in mind and select coverage that best meets your needs.

Q: Do I qualify for Term Life

Insurance?

When you apply for any type of life insurance, you need to answer some basic questions about your health and lifestyle. Most people who are generally healthy will qualify for coverage. You may still qualify for term life insurance if you have some existing health problems, although your premium will likely be higher.

For some policies, you do not need to submit evidence of insurability beyond the application questionnaire, meaning you shouldn't need a physical examination to qualify for coverage.

Q: When should I buy Term Life Insurance?

The best time to buy term life insurance is now. Life insurance is intended to provide a cash death benefit to your named beneficiary (or beneficiaries) after you die. Of course, none of us can know when we'll die, or when our health situation might change for the worse. Because qualifying for term life insurance is based on your health at the time of application, it just makes sense to buy coverage now. Hopefully, your term life insurance policy will never be needed. If it is, your loved ones will appreciate the fact that you took the time for insurance planning when you did.

Q: Can I afford Term

Life Insurance?

Because it is intended to provide coverage only for a specific amount of time, term life insurance is generally the least expensive type of life insurance you can buy. Your specific premium will be based on your age at the time you purchase the policy, as well as on your overall health. Non-smokers in good health will typically pay low premiums.

Would You Like to Request a Quote?

Please fill out the short form so we can provide you with the policy options

to best match your coverage and financial needs.

Would You Like to Request a Quote?

Please fill out the short form so we can provide you with the policy options

to best match your coverage and financial needs.

Core Values

Our eight core values are the

driving force behind everything we do.

Largest Life Insurance Guide

Read our comprehensive guide to answer any life insurance questions you have.

Interactive Timeline

View our interactive timeline to

see what insurance is right for you

CONTACT US

DEBT FREE LIFE

Learn more about Symmetry Financial Group’s Debt Free Life program, which

can help you get out of debt in nine

years or less without spending any additional money.

PRODUCTS

• Mortgage Protection

• Final Expense

• Term Life Insurance

• Universal Life Insurance

• Disability Insurance

• Critical Illness Insurance

• Retirement Protection

• SmartStart Insurance

WHY SYMMETRY?

Copyright © 2025 Symmetry Financial Group. All Rights Reserved. | Privacy | Site Map

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and Charlene Cook. No offers, solicitations or recommendations are being made via this website in any state where one of those named Quility licensees does not have a license. Please see our License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and Stephen J. Brenes’s license numbers in each state.

CONTACT US

DEBT FREE LIFE

Learn more about Symmetry Financial Group’s Debt Free Life program, which

can help you get out of debt in nine

years or less without spending any additional money.

Charlene Cook

Copyright © 2025 Symmetry Financial Group. All Rights Reserved. | Privacy | Site Map

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and Charlene Cook. No offers, solicitations or recommendations are being made via this website in License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and Charlene Cook’s license numbers in each state.

No agent’s success, earnings, or production results should be viewed as typical, average, or expected. Not all agents achieve the same or similar results, and no particular results are guaranteed. Your level of success will be determined by several factors, including the amount of work you put in, your ability to successfully follow and implement our training and sales system and engage with our lead system, and the insurance needs of the customers in the geographic areas in which you choose to work.

custom_values.agent_bio=

custom_values.agent_brokerage=

custom_values.agent_headshot=

custom_values.agent_name=Charlene Cook

custom_values.agent_phone=(219) 895-8042

custom_values.agent_title=

custom_values.agentemail=

custom_values.booking_page_link=

custom_values.booking_thank_you_page=

custom_values.brag_link=

custom_values.claim_thank_you_page=

custom_values.confirm_sale=

custom_values.final_expense_booking_page=

custom_values.from_email=

custom_values.insurance_license_number=

custom_values.life_insurance_landing_page=

custom_values.logo_image_url=

custom_values.outbound_email=

custom_values.recruiting_booking_link=

custom_values.twilio_number=(219) 271-7031

custom_values.twilio_number_in_link_form=Tel: (219) 271-7031

custom_values.licensenumber=